Our Services

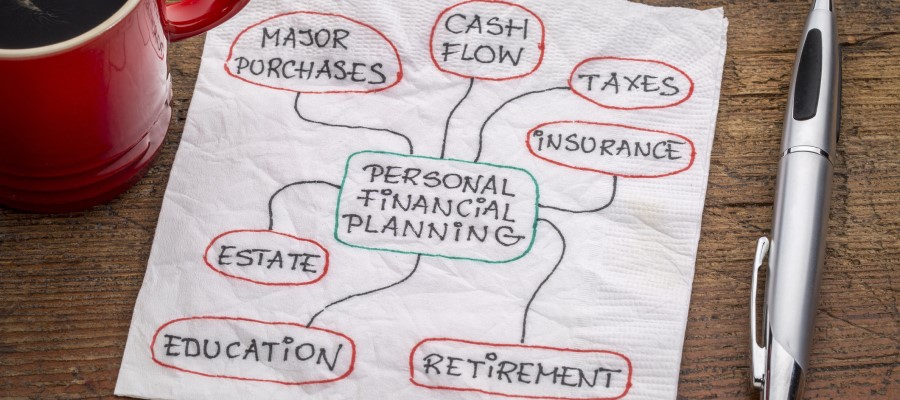

When developing a customized financial program, we walk our clients through a step-by-step process that is designed to make them feel confident in their decisions.

Once goals have been established, appropriate strategies are customized to suit each client's vision and objectives. We can help clients implement their sound financial program utilizing the following products and services:

Retirement planning

- Making the most of your employer-sponsored retirement plans and IRAs. Determining how much you need to retire comfortably. Asset management strategies before and during retirement.

Tax optimization strategies

- Looking for ways to help reduce your current and future tax burden. Referring you to qualified tax specialists.

Estate planning

- Reviewing your wills and trusts. Helping preserve your estate for your intended heirs. Helping with beneficiary designations. Reducing exposure to estate taxes and probate costs. Coordinating with your tax and legal advisors.

Risk management

- Reviewing existing insurance policies. Recommending policy changes when appropriate. Finding the best policy for your situation.

Education funding

- Recommending investment and accumulation strategies to help you pay for your children's education.

Investment Planning

- Determining your asset allocation needs. Helping you understand your risk tolerance. Recommending the investment vehicles to help you reach and exceed your goals.

Employee and executive benefits

- Helping your business attract and retain qualified employees through benefit packages.

*Financial plan recommendations can be implemented with the advisor of your choosing. Implementation of specific products or services may result in commissions or fees outside of the financial plan fee. Periodic reviews of your financial plan may require a new planning agreement and result in additional fees.

Neither MML Investors Services [nor any of its employees or agents] are authorized to give legal tax advice. Consult your own personal attorney legal or tax counsel for advice on specific legal and tax matters. Any discussion of taxes is for general information purposes only, does not purport to be complete or cover every situation, and should not be construed as legal, tax or accounting advice. Clients should confer with their qualified legal, tax and accounting advisors as appropriate.

Estate Planning services are provided working in conjunction with your Estate Planning Attorney, Tax Attorney and/or CPA. Consult them for specific advice on legal and tax matters.